Introduction and Main Points: Increased Startup Fundraising Alongside Stagnation in High-tech Employment Growth –

An overview of the Innovation Authority’s Annual Report for 2025 reflects the resilience and durability of the high-tech sector in the face of ongoing challenges. Although Israeli high-tech remains in prolonged stagnation in key metrics such as high-tech output and employment, other indicators are showing early signs of recovery and growth. In this sense, with future trends still uncertain, the sector remains at the same crossroads highlighted in last year’s report.

The central questions currently facing Israeli high-tech are: will the recovery in startup investment be translated into increased high-tech recruitment in Israel? How will Israel’s international standing affect the ability of Israeli high-tech companies to grow and thrive in a sector dependent on foreign investors and customers, in light of the ongoing war? And how will the Artificial Intelligence revolution influence the skills and needs of the sector’s workforce, and will it spark a new wave of entrepreneurship after years of decline in new startup formation?

Previous Innovation Authority publications have shown that most of the state’s revenue from high-tech is linked to its employees. This report presents a strong correlation between high-tech employment and the sector’s share in Israel’s GDP and exports. As a result, employment-related trends in the sector, and specifically the stagnation observed over the past three years, are expected to have broad impacts on Israel’s economy.

As far as key macro-economic indicators are concerned, Israeli high-tech output remained virtually unchanged in 2024 for a second consecutive year, constituting about 17% of GDP, or approximately USD 317 billion. Similarly, both the number of the sector’s employees and their relative share of all employees in Israel have remained stagnant, with almost no change for three consecutive years. About 403,000 people were employed in Israeli high-tech in the first half of 2025 – 11.5% of the national workforce. The number of employees in high-tech R&D roles declined by 6.5% in the first half of 2025 compared to the same period the previous year. Since 2023, the growth rate of high-tech employment has dropped to below 2% per year, following a decade in which it mostly stood at more than 5%.

In contrast, high-tech’s share of Israeli exports continues to grow. In the first half of 2025, high-tech accounted for about 57% of Israel’s exports, and in 2024 totaled USD 78 billion. It should be noted however, that the increase in high-tech’s share of exports is partly driven by a decline in other export sectors, such as tourism, due to the war. In addition, according to an analysis presented for the first time in this publication, 6.6% of high-tech exports are exposed to “Trump tariffs”. This analysis provides an estimate of the potential impact of these tariffs.

On the positive side is the continued recovery of investments in Israeli startups. Fundraising by Israeli technology companies has returned to 2019-2020 levels. Israel maintains a leading global position in this metric, ranking as the fifth-largest hub in the world for startup fundraising in 2024, after San Francisco, New York, London, and Boston. Investments in Israeli startups continue to be concentrated in two sectors: 3 out of every 5 shekels raised in 2025 were invested in cyber or organizational software companies. Israel also continues to lead globally in state expenditure on R&D as a percentage of GDP – a gap that is expanding relative to most OECD countries.

Thanks to the mega-deal in which Google acquired the Israeli company ‘Wiz’, 2025 is showing signs of being a record year in exits by Israeli companies. At the same time, the number of mergers and acquisitions of Israeli companies in recent years has been lower than the multi-year average recorded in 2015-2022.

Another notable trend is the decline in fundraising by Israeli venture capital funds. According to data presented in this publication, years characterized by global or local financial crises (e.g., after 2008 and in the past two years) have a significant impact on the fundraising of Israeli venture capital funds. The average size of VC funds created in Israel between 2023-2025 declined dramatically compared to funds raised in most years between 2017 and 2022. While VC fundraising has also dropped in the United States and Europe, the decline in Israel has been larger, both in total capital raised and in average fund size.

At the same time, the multi-year decline in the establishment of new technology companies is continuing. The number of new startups in Israel is less than half of those founded a decade ago, and most of them are focused in sectors where Israeli high-tech is already concentrated – organizational software, fintech, e-commerce, and cyber. It is too early to tell whether Artificial Intelligence will create a new wave of technological entrepreneurship, similar to that observed during the waves of smartphone and cloud innovation.

More broadly, it is difficult to identify measurable changes in macroeconomic data that can explain the possible effects on Israeli high-tech of the introduction of AI technologies. Given the multitude of factors influencing the sector domestically and globally, it is difficult to isolate the impact of this development (on labor productivity in high-tech, sector output, and changes in employment, entrepreneurship, and more).

Deep-Tech in Israel – A Current Overview

This annual report presents a detailed analysis of the deep-tech sector in Israel. The Innovation Authority views deep-tech as an important area, representing the forefront of technological innovation, and characterized by high technological risk and long time-to-market – conditions that can hinder companies in this field from raising capital and may lead to market failures. The findings presented here are drawn from a more comprehensive report published by the Authority in collaboration with Dealroom. The Israeli Deep-Tech Report 2025 includes in-depth examination of active companies in this sector in Israel, their investments and investors, and global comparisons based on a uniform definition.

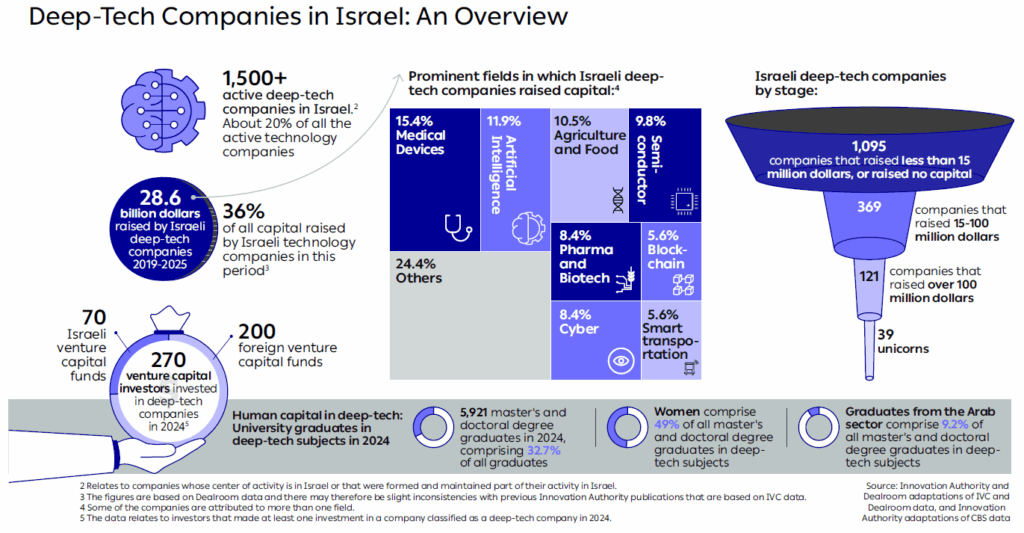

As of 2025, there are over 1,500 active deep-tech companies in Israel across all areas of high-tech. Approximately a quarter of these companies have been founded since 2019,1 since raising more than USD 28 billion – positioning Israel 5th globally and 1st outside the US. More than half this sum was raised in rounds above USD 50 million, and more than one quarter was raised by deep-tech companies in Artificial Intelligence. The data also shows that 270 venture capital funds, a quarter of which are local funds, invested in at least one Israeli deep-tech company in 2024.

Israeli deep-tech companies stand out in several areas: more than 20% of deep-tech capital raised in the cyber sector worldwide was raised by Israeli companies. Furthermore, Israeli deep-tech companies raised a significant share of global deep-tech capital in the fields of medical devices, agriculture, and food, attracting about 9%-10% of total global fundraising in these fields.

Deep-tech companies require high-quality human capital: skilled personnel, often with advanced academic degrees, to develop complex research-based technologies. In terms of the talent pool available to lead development in deep-tech companies, around 6,000 students graduated with advanced degrees in deep-tech subjects in 2024, including 5,000 master’s degree graduates and 1,000 doctoral graduates. About one third of graduates were in medicine and biology, and another 20% in computer science, electrical engineering, and mathematics. Moreover, the number of graduates in deep-tech subjects has been increasing consistently for more than a decade, at a pace that exceeds population growth

In light of the data presented here and against the backdrop of the local and global challenges faced by the sector in a time of ongoing war, the critical crossroads of Israeli high-tech become even clearer. The decisive question of the next few years will be whether Israeli high-tech can return to the growth trajectory that characterized it for more than a decade (until 2022). Specifically, the key issues will be growth in high-tech employment and the global perception of Israel in the eyes of clients, investors, and multinational companies. Moreover, the impact of AI’s introduction into the sector has yet to be fully understood.