Introduction and Background: Deep-Tech in Israel

This section presents a joint study conducted by the Innovation Authority and ‘Dealroom’, surveying the deep-tech sector in Israel and comparing its activity to leading global hubs competing with Israel.

For the purpose of this publication, a deep-tech company is defined as a company developing complex technology that, due to the complexity of the R&D, is typically characterized by long maturation periods, and which usually requires highly educated and skilled human capital as well as significant financial resources to complete the development process.1For a more detailed definition, see the Israeli Deep-Tech Report 2025, jointly published by the Innovation Authority and Dealroom. The full publication presents the definition of an Israeli company and details regarding the overlap between the deep-tech and life sciences sectors.

While deep-tech companies operate across all areas of high-tech, certain sectors are characterized by a relatively high presence of these companies e.g., space, semiconductors, and quantum. Sectors with relatively lower deeptech presence include, among others, e-commerce and marketing, content and media, and organizational software.

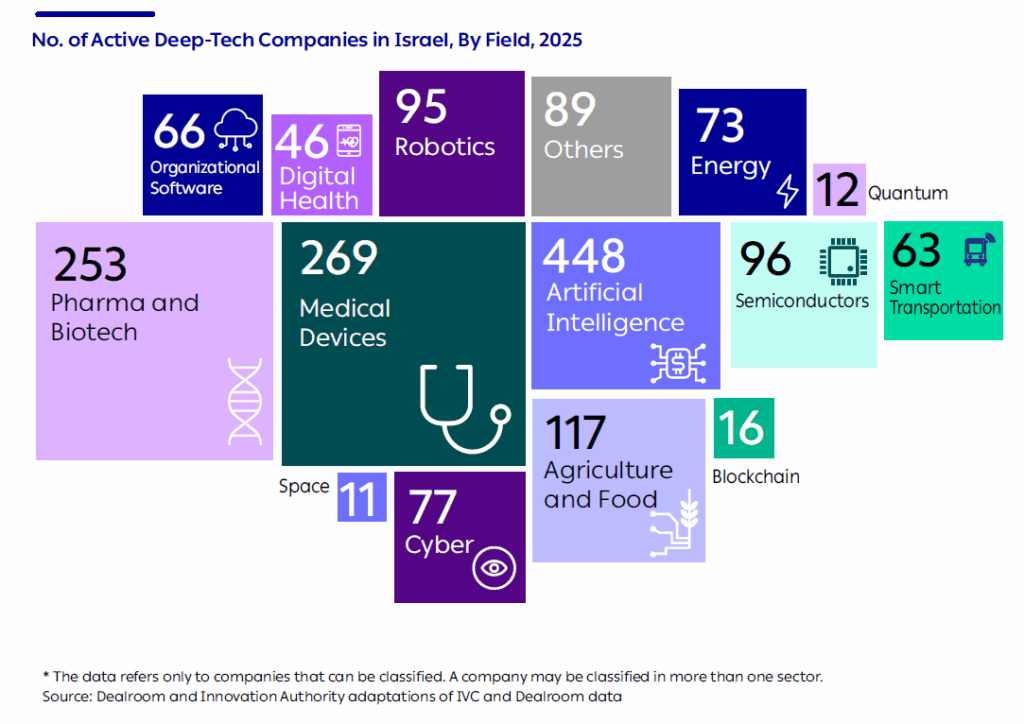

An analysis of the data shows that, as of the date of this report, more than 1,500 deep-tech companies operate in Israel.2For the purpose of the analysis, every Israeli technology company was classified according to the definition above, as either a deep-tech company or not. The classification was conducted jointly by Dealroom and the Innovation Authority, based on data from Dealroom and IVC. Of this total, about 1,300 companies maintain their main operations in Israel and have conducted a fundraising round. A further 100 companies conducted a fundraising round but moved their headquarters outside Israel (while maintaining some local operations), and about 130 companies maintain their main operations center in Israel but have yet to conduct a fundraising round. Between 2019-2025, they raised over USD 28 billion3The 2019-2025 period was chosen in order to present a sufficiently long-term and reliable picture. Given the numerous global and domestic events beginning with the outbreak of the Covid pandemic in 2020, it was decided to select 2019 as the analysis starting point. – approximately 36% of the total capital raised by Israeli high-tech companies during this period.4total capital raised as reported in the joint publication by the Innovation Authority and Dealroom is about 15% lower than the figures appearing in IVC data for this period, due to differences in definitions. This ranks Israeli deeptech companies fifth in the world in terms of fundraising, and in first place outside the United States. The data also shows that 270 venture capital funds (a quarter of them Israeli funds) invested in at least one Israeli deeptech company in 2024.

How to Identify a Deep-Tech Company?

Main Criteria

- Time to Market or Complexity

Technology requiring long maturation periods due to complex R&D, usually involving the development of innovative intellectual property (IP) or tangible product by personnel with advanced academic degrees.

- דרישות הון

Significant capital investment is required to finance the R&D process, typically more than in companies developing non-deep-technologies.

Secondary Criterion

- קניין רוחני (IP) ו-Spinouts

Companies that possess significant intellectual property and which commercialize research-driven innovation are highly likely to be deep-tech.

Note: A company can be defined as deep-tech even without patents or a spinout structure – both of which are regarded as “soft metrics”.

Mapping Sectors on the Deep-Tech Spectrum

Most Deep-Tech Companies in Israel: In the AI, Medical Devices, and Pharma Sectors

As of this report’s publication, there are over 1,500 deep-tech companies operating in Israel. Nearly a quarter of these have been founded since 2019.

The three main sectors in which more than half of Israel’s deep-tech companies operate are medical devices, pharma, and Artificial Intelligence.

Over 2,000 AI companies operate in Israel, of which 538 are defined as deep-tech companies.5In this publication, an AI company is defined as one engaging exclusively in the development of AI infrastructures (including development of basic models, MLOps tools and vector databases). In contrast, a company assimilating AI tools in other sectors will be classified according to its field of activity. 146 of these engage in developing AI infrastructures and 392 operate in various sectors e.g., development of advanced AI applications for agriculture, pharma, or development of microchips for AI.

A Quarter of the Capital Raised by Israeli Deep-Tech Companies Was in Medical Devices and Pharma

Companies developing medical devices and pharma raised about one quarter of the total capital raised by Israeli deep-tech companies between 2019-2025, a sum of USD 7.4 billion. Another prominent field in Israeli deep-tech is Artificial Intelligence, where companies raised USD 3.4 billion during this period.

Israeli deep-tech companies stand out in several fields globally relative to the size of the Israeli ecosystem. Israeli cyber companies defined as deep-tech raised about USD 2.4 billion between 2019-2025, more than 20% of the total capital raised by deep-tech companies in the cyber sector worldwide. In the fields of medical devices and agriculture and food, Israeli deep-tech companies also raised a significant share of global deep-tech capital – attracting about 9%-10% of total global fundraising in these fields.

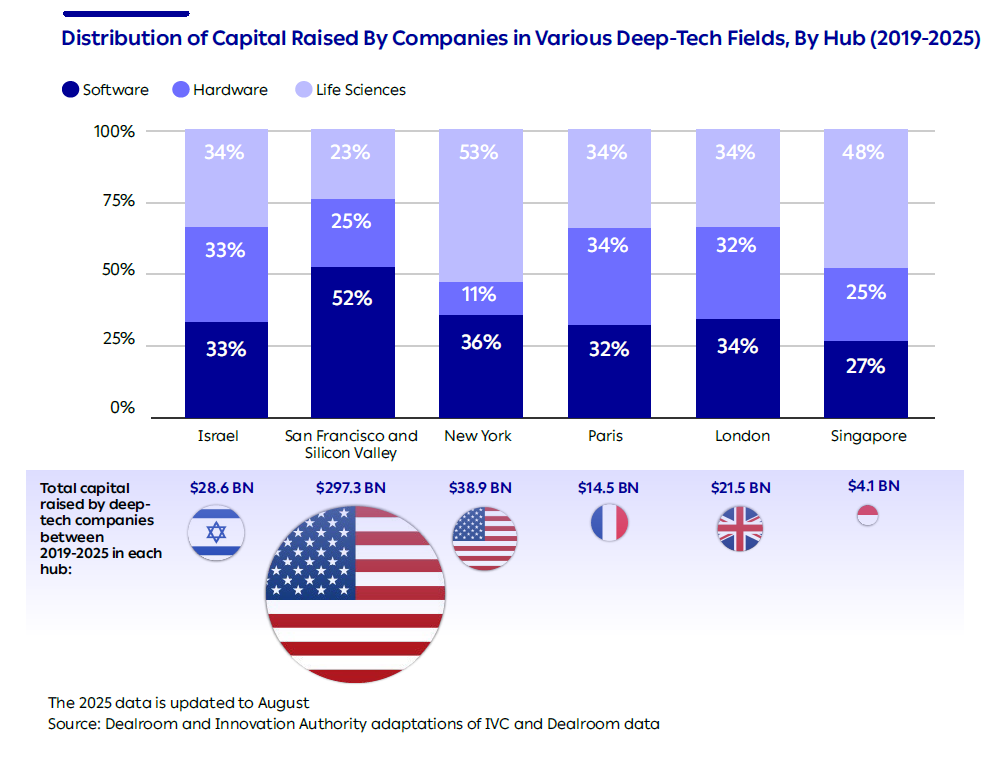

Israel Ranks 1st Outside the US in Global Deep-Tech Fundraising

Israel ranks as the fifth hub in the world in terms of capital raised by deep-tech companies during 2019-2025.6The list of hubs here was chosen by the relevance of their comparison to Israel and is not an exhaustive list (e.g., Austin in the US is not included).The hubs ranked above Israel are all located in the United States, making Israel the largest hub outside the US in terms of deep-tech fundraising.

As shown above, Israel also ranks fifth in total startup fundraising. In other words, Israel’s global position among the hubs in deep-tech fundraising is similar to its standing in the overall high-tech sector.

Between January-August 2025, total deep-tech fundraising in London slightly exceeded that in Israel, totaling USD 2.4 billion compared to USD 2.2 billion in Israel.

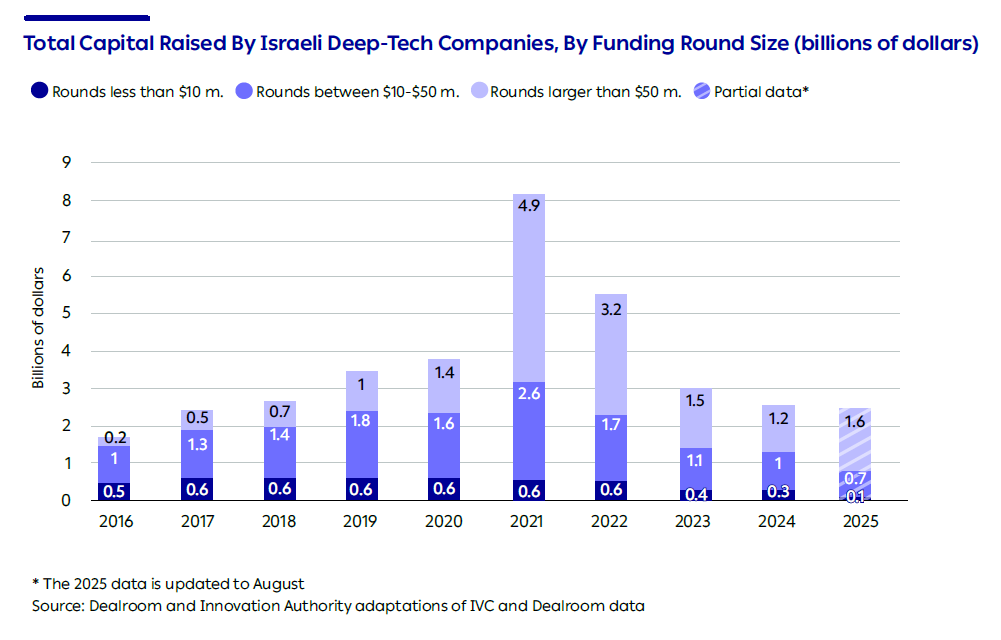

Most of the Capital Raised by Israeli Deep-Tech Companies: In Rounds of Over USD 50 Million

In recent years, most of the capital raised by Israeli deep-tech companies has been in large funding rounds – similar to the trend observed in the high-tech industry as a whole.

In 2024, about half the capital raised by Israeli deep-tech companies was in large rounds of more than USD 50 million – compared to only 10% in 2016.

In the first eight months of 2025, this trend appears to be continuing, with large rounds accounting for 65% of all investments in deep-tech companies. However, this figure is expected to decline slightly since smaller rounds are more difficult to detect – a challenge commonly referred to as late detection.

Investments in Israeli Deep-Tech Are Distributed Similarly to London and Paris – Across Software, Hardware, and Life Sciences Companies

An analysis of capital raised by the prominent fields in Israeli deep-tech companies between 2019-2025 reveals a generally even distribution of investments across three areas: software, hardware, and life sciences.

This distribution is very similar to that in London and Paris. In contrast, about half the investments in deep-tech in San Francisco and Silicon Valley is concentrated in software companies, while half the investment in Singapore and New York during this period was concentrated in life sciences companies.

Hundreds of Investors Operate in the Israeli Deep-Tech Sector

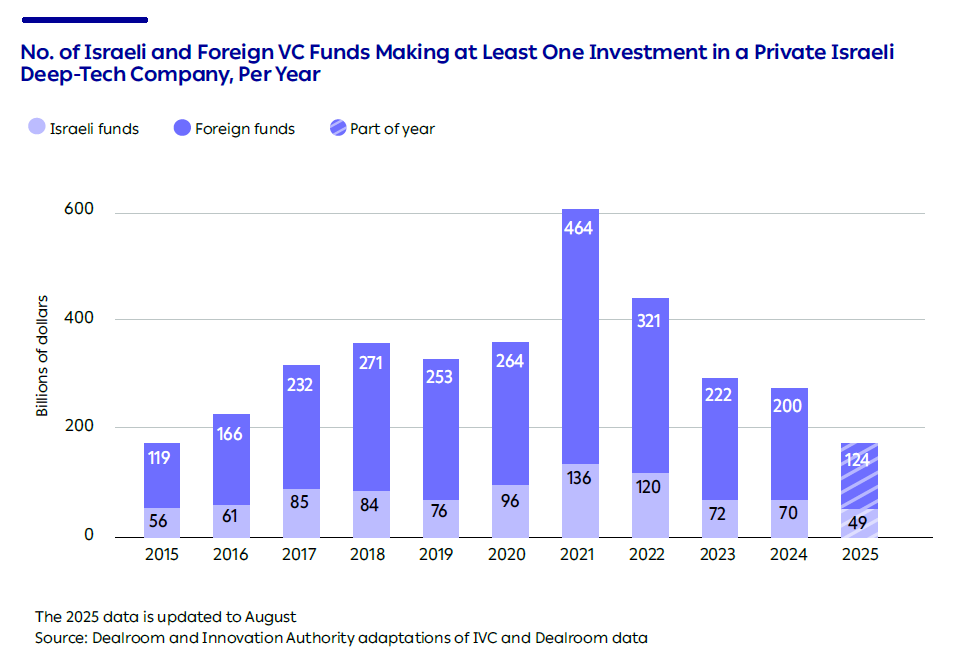

In recent years, the number of active investors in Israel’s deeptech sector has been in decline. In 2023-2024, about 280 different venture capital funds invested in at least one Israeli deep-tech company. In 2025 (up to August), around 170 funds made at least one investment in Israeli deep-tech companies. These figures are relatively low compared to 2017-2022, when an average of 400 funds invested in Israeli deep-tech companies each year. It should be noted that the figures for the most recent years are still expected to be updated upward.

At the same time, the ratio of Israeli investors of all deep-tech investors has remained stable over the years, averaging about 26% of the total number of investors.

In the Past Decade: Exits Valued at Over USD 60 Billion by Israeli Deep-Tech Companies

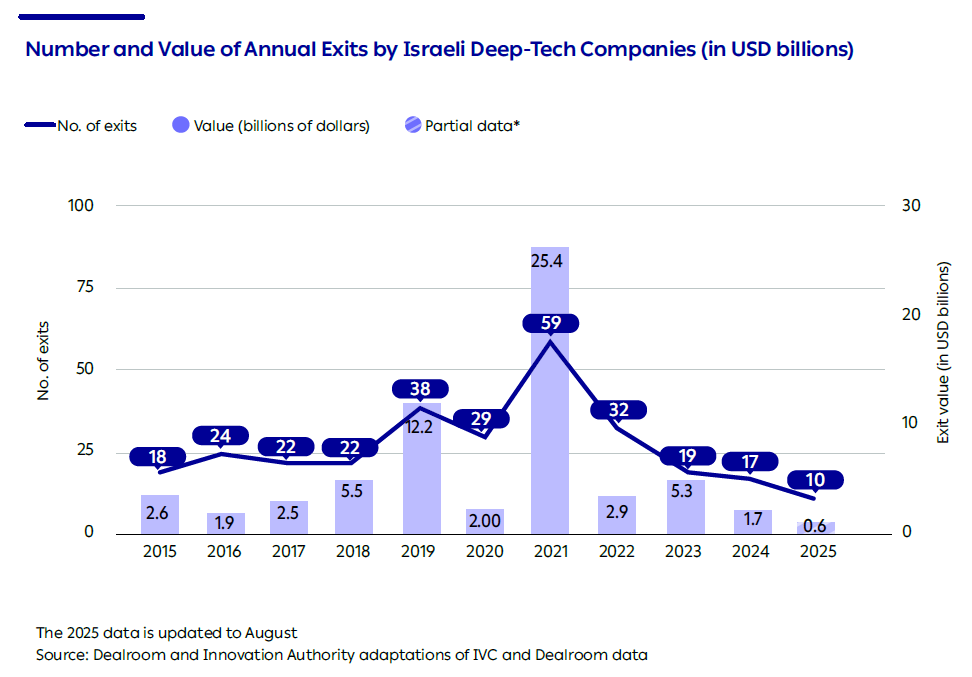

Over the past decade, there has been an average of 28 exits per year by Israeli deep-tech companies, with an average deal size of around USD 220 million.7The analysis includes initial public offerings (IPO) and mergers and acquisitions (M&A).

2021 was a record year, both in the number and value of deals, mainly due to the IPO of SentinelOne at a valuation of about USD 9 billion. Significant deals were also recorded in 2019, primarily in semiconductors – Mellanox was acquired by Nvidia for approximately USD 6.9 billion, and Habana Labs was acquired by Intel for about USD 2 billion.

Since the peak of 2021, the number of exits by Israeli deep-tech companies has declined each year, with only 17 exits recorded in 2024. By contrast, in Israeli high-tech overall, there has been a slight recovery in annual exit activity, with 187 exits recorded from the beginning of 2024 through the first half of 2025.

The Core of Deep-Tech Companies: Skilled Human Capital

Deep-tech companies require highly skilled personnel, often with advanced academic degrees, to develop research-based deep-technologies. To assess the availability of human capital in the field and the capacity of companies to grow, the Innovation Authority defined a list of advanced degrees relevant to various deep-tech fields (“deep-tech subjects” as detailed in Appendix 1) and examined the number of university graduates in these fields over time.

It is important to emphasize that while graduates of these degrees represent the potential talent pool for employment in deep-tech companies, they will not necessarily be employed there. Furthermore, deep-tech companies also employ personnel in roles outside the R&D core, meaning that graduates of other disciplines are also employed in product and headquarter positions.

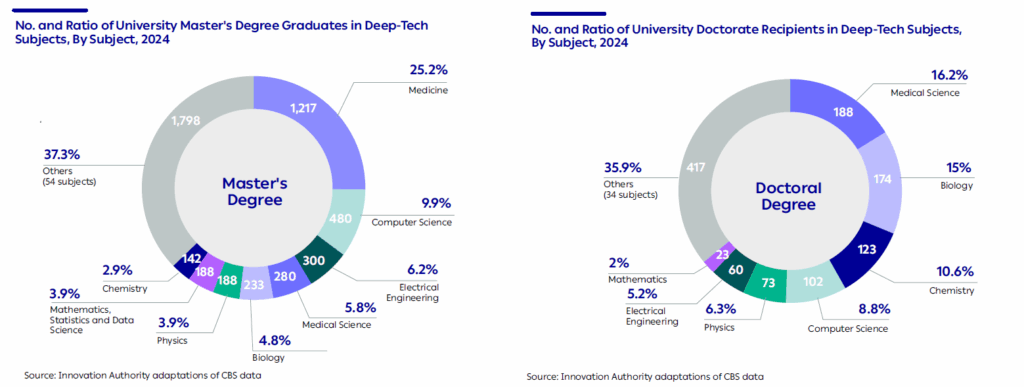

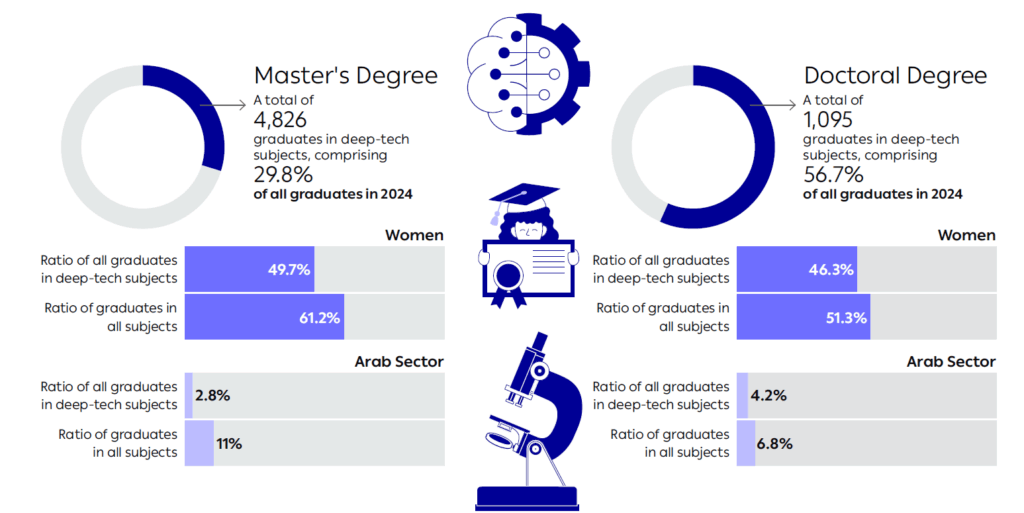

The data reveals that the number of graduates with advanced degrees in deep-tech subjects has been rising consistently for more than a decade, at a pace exceeding that of the population’s growth. The data further shows that about 6,000 students completed advanced degrees in deep-tech subjects in 2024, accounting for roughly one third of all advanced degree graduates. Of these, around 5,000 completed a master’s degree and 1,000 a doctorate. One third of the graduates were in medicine and biology, and another 20% in computer science, electrical engineering, and mathematics.

An analysis of the demographic composition of advanced degree graduates in deep-tech subjects reveals that about half are women. However, this ratio is lower than the ratio of women of all advanced degree graduates, which exceeds 60%.

By contrast, the ratio of graduates from the Arab sector is significantly lower than their proportion of the general population. While the Arab population constitutes about 21% of Israel’s total population, only 2.8% of master’s degree graduates in deep-tech subjects are Arab. Their ratio of doctoral graduates is only slightly more encouraging, with approximately 4.2% of graduates in deep-tech subjects coming from the Arab sector.

Human Capital in Deep-Tech: 2024 Overview

Increase in the Number of Advanced Degree Graduates in Deep-Tech Subjects

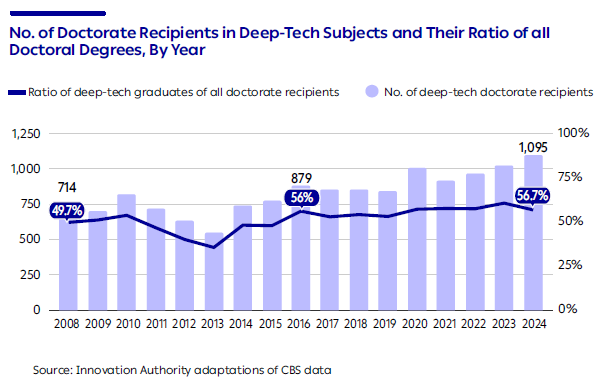

The number of advanced degree graduates in deep-tech subjects has been rising since 2013. The number of master’s degree graduates in these subjects increased from about 3,000 per year between 2008-2013 to nearly 5,000 in 2024 – an increase of 63%.

A similar trend can be observed in doctoral degrees: the number of graduates in deep-tech subjects rose from an average of 700 per year between 2008-2013 to more than 1,000 in 2024 – an increase of 53%. The number of advanced degree graduates in deep-tech subjects has grown at a faster rate than population growth during this period.25

Prominent Fields of Study in Deep-Tech Subjects: Medicine, Computer Science, and Life Sciences

The most popular field of study for master’s degrees in deep-tech subjects is medicine, accounting for about one quarter of graduates. Close to 11% of the graduates were in biology and medical science, while approximately 20% of the master’s degree graduates were in the deep-tech subjects most closely associated with the high-tech sector – computer science, mathematics, and electrical engineering. Doctoral graduates present a similar picture: graduates in biology and medical science account for about 31% of all deep-tech subject graduates, while graduates in computer science, electrical engineering, and mathematics account for about 16%.