Mapping the Israeli Ecosystem and Global Comparison

Introduction

The development of clean hydrogen – hydrogen produced through processes with low or zero carbon emissions – is a central component in global strategies for transitioning to clean energy. Its importance lies in its potential to replace fossil fuels across a wide range of sectors, including heavy industry, transportation, power generation, and energy storage. The main advantage of hydrogen is its ability to store and transport renewable energy flexibly, thereby bridging the gap between production and consumption.

Globally, many countries have announced plans to invest in hydrogen by 2030, with total commitments exceeding USD 570 billion. Of this sum, approximately 7% is designated for projects that have reached an advanced planning stage. Despite these commitments, regulatory barriers and high costs continue to delay large-scale hydrogen investments and project implementation.

At the same time, as part of global efforts to accelerate the development of green hydrogen, over 100 “Hydrogen Valleys” have been established worldwide – regions that concentrate technological players, research institutions, and infrastructure to create innovative ecosystems enabling research, pilot projects, and hydrogen-based applications across various sectors.

Against this backdrop, this review examines whether Israel can integrate into the international clean hydrogen landscape and whether the Hydrogen Valleys model could serve as a growth driver for Israeli startups. It explores Israel’s position in the global hydrogen market, the characteristics of active local companies, and compares the Israeli market with international developments. Additionally, the review evaluates the potential of the Hydrogen Valleys model as a tool for promoting local startup growth.

Overview of Israel’s Hydrogen Landscape

A total of 26 Israeli companies have been identified as active in the hydrogen field, engaged in production, transportation, storage, utilization, purification, and the development of hydrogen-based energy products.

Technologies for Clean Hydrogen Production

Technologies for Clean Hydrogen Production

Israeli companies in the hydrogen sector operate across a range of technologies that produce hydrogen through three main pathways: green, blue, and turquoise.

Green hydrogen is produced by water electrolysis using renewable energy sources, making it entirely clean and carbon-free. Blue hydrogen is produced from natural gas through a reforming process in which the emitted carbon is captured and stored using carbon capture technologies, reducing, though not eliminating, emissions. Turquoise hydrogen is produced through methane pyrolysis, in which carbon is generated in solid form rather than being released into the atmosphere.

Blue and turquoise hydrogen are classified as low-carbon hydrogen, produced from non-renewable energy sources but through processes with low carbon emissions. All three types – blue, turquoise, and green – fall under the broader definition of clean hydrogen.

In electrolysis-based production (green hydrogen), several Israeli companies stand out, including H2Pro, which has developed the highly efficient E-TAC technology; Hydrolite, which utilizes alkaline membranes to reduce production costs; Purammon, which generates hydrogen from wastewater; and QD-SOL, which combines quantum technology with photovoltaic electrolysis.

In thermal technologies, the Israeli company PyroH2 develops a methane pyrolysis process for producing turquoise hydrogen, while Technologies Airovation works on natural gas reforming with carbon capture for blue hydrogen production.

In waste-to-hydrogen technologies, Boson Energy and Co-Energy utilize gasification and pyrolysis processes to convert organic or industrial waste into green hydrogen.

Additionally, several Israeli companies operate in chemical reaction-based hydrogen production, including Ionflux, which produces hydrogen through a reaction between water and aluminum-based fuels, and GenCell, which generates hydrogen and nitrogen through the decomposition of ammonia. Both technologies are classified as green hydrogen, depending on the energy source used.

Company Development Stages

Company Development Stages

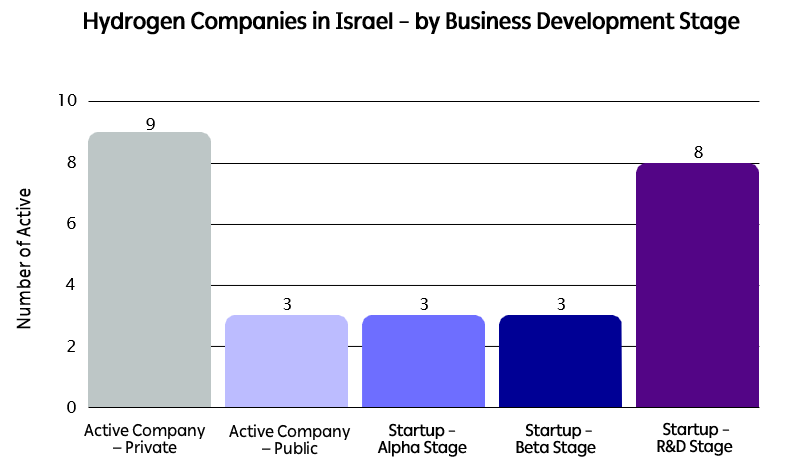

According to data collected from SNC, IVC, and Pitchbook, Israel has eight hydrogen companies currently in the research and development or pilot stages (Alpha or Beta), three publicly traded companies, and nine private companies generating independent revenue.

Source: Innovation Authority adaptation of data from SNC, IVC, and Pitchbook

Distribution of Company Activity Areas

Distribution of Company Activity Areas

Fifteen Israeli companies are engaged in hydrogen production using various technologies. Five companies primarily focus on developing hydrogen-based products. Three companies operate in the fields of hydrogen transportation or storage, and three others are active in hydrogen purification.

Investments in Israel

Investments in Israel

An analysis of investors in Israeli hydrogen companies, based on Pitchbook data, reveals a diverse picture that includes a wide range of investors and funds. The most significant number of investors – 38 public and private – are from Israel, and Israeli investors also lead in terms of total investment volume. Other countries with a notable presence include the United States, Belgium (primarily through the European Innovation Council), Singapore (Temasek Holdings), Japan, Germany, Hong Kong, and the United Kingdom.

According to Pitchbook data, 2022 marked a record year for investment activity (both private and governmental) in Israeli hydrogen companies, with total funding of approximately USD 115 million, including capital raises, grants, and other investments. Three major funding rounds were recorded that year:

In 2020, total investments amounted to USD 90 million, driven mainly by significant rounds in GenCell and Nanoscent. In contrast, investment activity declined notably in 2023 and 2024, totaling only USD 6.8 million across Israeli hydrogen companies.

In 2023, the Ministry of Energy allocated NIS 130 million to establish a research institute for energy storage at Bar-Ilan University and the Technion-Israel Institute of Technology. The five-year grant also covers research on hydrogen storage. Additionally, in 2024, the Ministry approved three R&D and demonstration projects with a total grant volume of NIS 4 million, as well as nine additional academic projects totaling NIS 3.8 million.

Furthermore, Doral Energy received a grant from the Ministry of Energy to develop a pilot project for green hydrogen production in Yotvata. The project was considered an essential step toward developing green hydrogen infrastructure in Israel; however, its progress has been limited primarily due to regulatory challenges.

Global Comparison

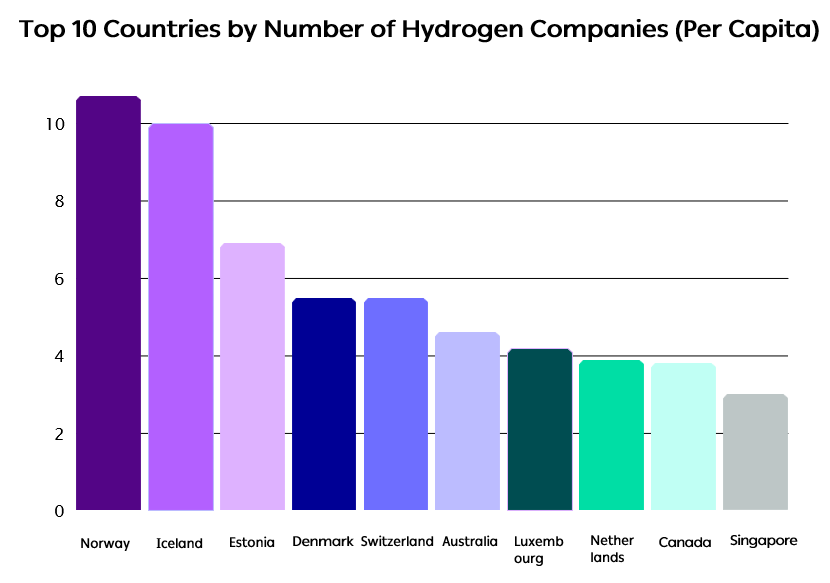

Israel ranks 16th worldwide in the number of hydrogen-related companies per capita. As shown in the following chart, smaller countries with advanced energy infrastructures and firm climate policy commitments lead this index.

Israel ranks 19th globally in terms of the total number of hydrogen companies. The leading countries in this category are: the United States (488 companies), China (288), Germany (119), the United Kingdom (155), Canada (117), Australia (112), France (89), South Korea (84), Japan (49), Spain (46), and the Netherlands (45).

Source: Innovation Authority adaptation of data from Pitchbook and the Population and Vital Statistics Report

Total Investments

Total Investments

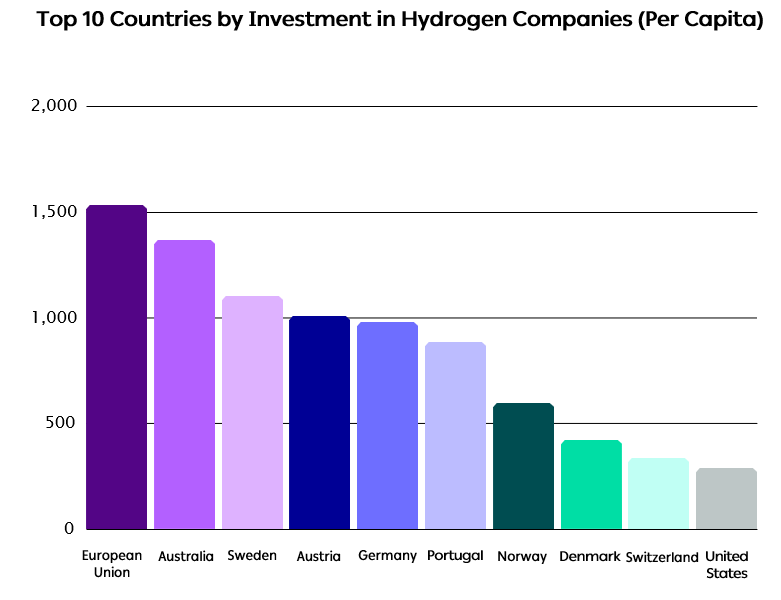

Israel ranks 23rd worldwide in total hydrogen-related investments (public and private) per capita, and 29th in overall investment volume in hydrogen companies.

Source: Innovation Authority adaptation of data from Pitchbook and the Population and Vital Statistics Report

Many countries around the world have declared their commitment to invest in clean hydrogen (hydrogen produced without carbon emissions during production, as well as hydrogen generated using carbon capture technologies). The total planned investments amount to approximately USD 570 billion by 2030. Of this sum, USD 39 billion has reached the Final Investment Decision (FID) stage, meaning these projects have completed advanced planning and received final approval for investment. The distribution of planned investments by sector is as follows: clean hydrogen supply (75%), end-use applications (15%), and clean hydrogen infrastructure (10%).

The total investment volume in projects that have reached the FID stage has increased more than sevenfold over the past four years (from USD 10 billion to USD 75 billion). However, alongside the significant rise in announced investments in clean hydrogen implementation projects in recent years, regulatory uncertainty and high production costs make it difficult to carry out projects and to realize the announced investments.

The Hydrogen Valleys Model Worldwide

A Hydrogen Valley is a defined geographic area where technologies from various renewable energy sources are integrated for the production, transportation, storage, and utilization of hydrogen, forming a single, comprehensive system. In most Hydrogen Valleys, hydrogen applications are integrated across multiple end-use sectors, including transportation, industry, and blending hydrogen into natural gas networks.

Electrolysis technology serves as the primary method of hydrogen production in Hydrogen Valleys, using models such as PEM (Proton Exchange Membrane), AEL (Alkaline Electrolysis), and SOE (Solid Oxide Electrolysis), alongside SMR (Steam Methane Reforming) combined with CCUS (Carbon Capture, Utilization and Storage), which is less common. Hydrogen storage is mainly based on compressed hydrogen, with additional solutions including liquid hydrogen, ammonia, and methanol. Hydrogen transportation is carried out using trucks, pipelines, and ships.

To assess whether the Hydrogen Valleys model could provide value to Israel’s ecosystem, an in-depth analysis was conducted of 15 Hydrogen Valleys in Europe and three major Hydrogen Valleys in the United States. The study found that these systems are typically based on partnerships among corporations, infrastructure companies, and research institutions.

The characterization of participants in the examined Hydrogen Valleys reveals the following:

- Collaboration between large companies and small- and medium-sized enterprises (SMEs).

- International partnerships.

- Participation of academic institutions or research centers.

- Involvement of major infrastructure companies (transportation, storage and logistics, energy, ports).

- Participation of local authorities, public bodies, associations, and foundations.

An analysis of 18 Hydrogen Valleys in Europe and the United States found that, on average, each valley includes five infrastructure or energy companies, two public entities, and four academic or research institutions. In contrast, only three early-stage startups were identified across all the valleys, two of which were established and funded by large corporations.

These findings suggest that the Hydrogen Valleys model, as implemented in significant projects in the United States and Europe, is not well-suited for integrating independent, early-stage startups.

Regulatory Initiatives and Global Challenges

The 2024 report of the International Energy Agency (IEA) highlights several challenges faced by clean hydrogen production projects:

- Uncertainty in demand resulting from insufficient commitment and clarity on the consumer side.

- Difficulties in financing large-scale projects.

- Regulatory delays and lack of clarity regarding the implementation of government incentives. The need for regulatory coordination has also been identified in Israel as one of the main obstacles to project implementation.

- Project cancellations and delays, as these challenges increase investment risk.

Alongside these challenges, there are also international guidelines and regulations aimed at promoting the integration of clean hydrogen into the global energy market.

| Country / Entity | Initiative | Description |

|---|---|---|

| European Union | Directive (EU) 1788 (2024) | A directive that establishes rules for integrating hydrogen into the gas market, including access to transmission networks, infrastructure separation, and investment incentives. The initiative aims to serve as the foundation for a unified hydrogen market across Europe. |

| European Union | Renewable Hydrogen Mandates (2023) | Under the Renewable Energy Directive (RED III), binding targets were set for integrating renewable hydrogen into sectors such as industry and transport. For example, by 2030, at least 42% of industrial hydrogen in Europe is expected to come from renewable sources. |

| U.S. Government | Production Tax Credit (PTC) (2025) | Under the Inflation Reduction Act (IRA), clean hydrogen producers are eligible for a tax credit of up to $3 per kilogram of hydrogen, depending on the emission level of the production process. |

| Inter-American Development Bank (IDB), in cooperation with OLADE – the Latin American Energy Organization – and the energy ministries of 14 Latin American countries | CertHiLAC (2023) | A regional framework for certifying clean and low-emission hydrogen in Latin America and the Caribbean. It aims to enable mutual recognition between countries, promote transparency and traceability of hydrogen sources, and strengthen the regional hydrogen market. |

| Japan | Contracts for Difference Mechanism (2024) | The Japanese government supports hydrogen projects through a mechanism that covers the gap between the production cost of clean hydrogen and its market price, enabling investment even when hydrogen is not yet economically competitive. |

| International Organization for Standardization (ISO Technical Committee) | ISO/TC (2023) | A standard for large-scale hydrogen systems, including the development of methods to measure greenhouse gas emissions across the hydrogen value chain – from production and transport to consumption. The standard aims to serve as a foundation for certification and regulation of “clean” or “sustainable” hydrogen. |

| Global | COP28 (2023) | At the COP28 Climate Conference in Dubai (2023), 37 countries committed to implementing mutual recognition of environmental certificates for hydrogen based on standard design principles. The goal is to prevent regulatory fragmentation and support global trade in clean hydrogen. |

Israel Innovation Authority Activity in the Clean Hydrogen Field

Since 2018, the Israel Innovation Authority has invested in 12 companies and projects in the clean hydrogen field through various funding programs. These include support for startups at the R&D stage, projects aimed at implementing academic-industry research collaborations, and support for international partnerships between companies. According to the Innovation Authority’s data, approximately 3% of its energy-related investments and around 15% of its renewable energy investments have been directed toward programs or companies developing clean hydrogen technologies.

- Under the BIRD Energy program, operated jointly by the Innovation Authority and the Ministry of Energy to promote collaboration between Israeli and U.S. companies, an investment of USD 7.5 million was announced in December 2024 for five projects. Among them was a project by the Israeli company Nitrofix and the U.S. company 1S1Energy, aimed at developing green ammonia (produced using hydrogen through a clean process).

- In 2023, the BIRD program also supported a joint project by the Israeli company Energy Boson and Drexel University in Pennsylvania. The partners developed a tar decomposition system that enhances the production of green hydrogen from biological sources.

- As part of a joint initiative with Snam, one of Europe’s largest energy companies, which promotes hydrogen innovation as part of the transition to clean energy, the Innovation Authority launched a call for proposals to advance hydrogen collaborations. Partnerships were established between Snam and the Israeli company H2Pro, including joint research, technology implementation, and participation in tenders in both Israel and Europe.

- Additionally, four Horizon Europe grants were awarded to promote R&D in the hydrogen field. The recipients included the Technion – Israel Institute of Technology, Ben-Gurion University of the Negev, and the company Hydrolite.

Summary

In recent years, clean hydrogen has emerged as a strategic component in the global transition to clean energy, with numerous projects and investment announcements from governments, corporations, and investors. However, the gap between declared ambitions and actual implementation remains significant. Regulatory barriers, high production costs, and technological risks continue to delay the realization of green hydrogen projects, highlighting the need for supportive policies, economic incentives, and suitable infrastructure. In Israel, regulatory uncertainty has also been identified as a key challenge in implementing green hydrogen projects.

In Israel, the hydrogen ecosystem positions the country impressively relative to its size, both in terms of the number of active companies and the volume of investments. Israeli companies operate across the entire hydrogen value chain, employing diverse and innovative technologies. An analysis of investors in Israeli hydrogen companies reveals a wide range of participants, with strong leadership from Israeli entities alongside significant international involvement, reflecting global interest in Israeli technologies.

The Hydrogen Valleys model, which is implemented worldwide, provides a platform for advancing research, pilot implementation, and regional collaboration. However, an analysis of Hydrogen Valleys in the United States and Europe reveals that most participating companies are well-established energy and infrastructure corporations, as well as public institutions and academia. Early-stage startups have minimal representation within this model. This finding suggests that alternative models should be considered to support young players and startups in Israel better.