Appendix 1: Human Capital in Deep-Tech – List of Relevant Study Subjects

The study subjects defined as deep-tech for the purpose of the analyses presented are:

The study subjects are presented according to the number of graduates, in columns from left to right i.e., the highest number of graduates in the field of Deep-Tech is in Medicine, followed by Computer Science, etc.

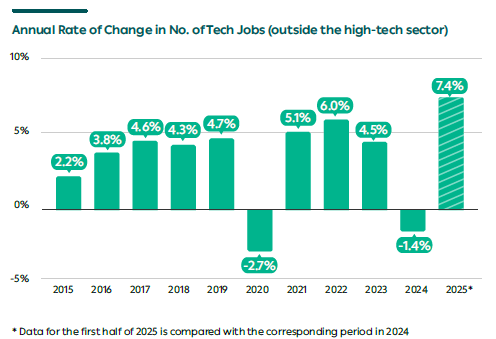

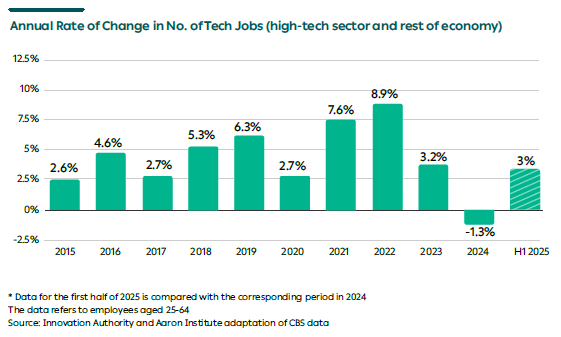

Appendix 2: Employment in Tech Jobs

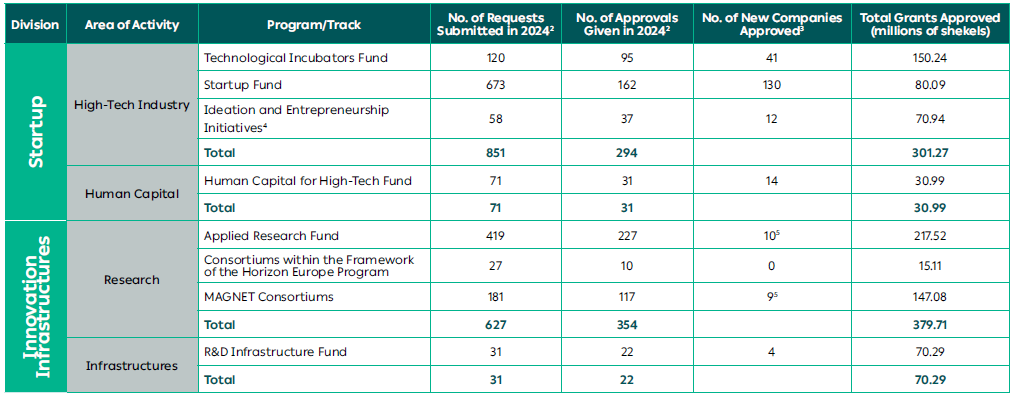

Appendix 3: Innovation Authority Activity in 2024

The Israel Innovation Authority endeavors to provide a solution to the different challenges facing the Israeli innovation hub via three operational units called “divisions”. Each division is mission-oriented and offers a unique toolbox that is adapted to the various challenges in the technological lifecycle. The Innovation Authority’s divisions undertook a variety of initiatives during 2024 with the aim of advancing the growth of the Israeli innovation hub.

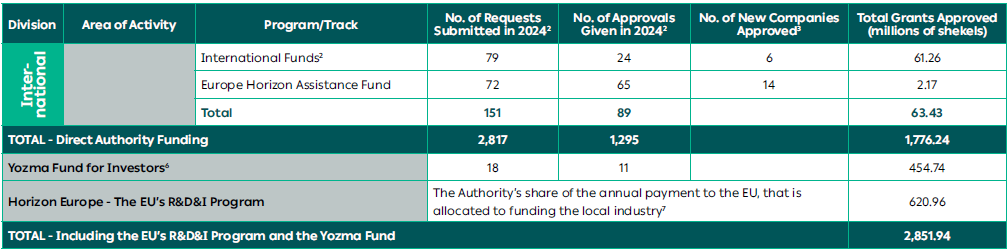

The table below details the different divisions’ activity last year, according to the programs they operate:1Descriptions of the different tracks and programs appear on the Innovation Authority website and in previous reports published by the Authority

(2) 8-12 weeks elapse in most requests between the time a request is submitted and the time it is brought to the committee for approval. Accordingly, the figures for 2024 approvals also include requests submitted at the end of 2023, and some of the submissions for 2024 (those submitted at the end of the year) which were only discussed by committees in 2025. Specifically, in the Bilateral Funds, over 40 of the submissions during 2023 were only discussed in 2024 while less than 20 submissions of 2024 were only discussed in 2025.

(3) The requests and approvals are presented according to files submitted. Some companies have several submissions and even several approvals in the same program or in several programs. Accordingly, companies that first received grants from the Authority in 2024 and which received more than one grant in the same program, are counted once under the definition “new companies in the same program”. Companies that first received grants from the Authority in 2024 in two different programs, are counted in each of the programs as “new companies”. Accordingly, a total of 382 new companies were approved in 2024.

(4) The Be’er Sheva Entrepreneurship, Advancing Growth Engines, and Young Entrepreneurship programs in the Startup Division are initiatives in which a franchisee is chosen to run the initiative for several years. During each year of the franchise, the franchisee is required to submit a yearly work plan before approval of the grant.

(5) In the Innovations Infrastructures Division, the grants in the Applied Research in Academia and some of the grants in Knowledge Commercialization Programs and the MAGNET Consortiums are awarded to researchers in academia. The number of submissions and approvals in these programs relates to all those submitting requests, however the number of new companies approved relates exclusively to companies (and does not include researchers).

(6) As part of the Yozma 2.0 Fund, the Authority provides 23% of the total investment framework in Israeli VC funds of institutional entities applying to the program. These investment frameworks are approved in USD at an exchange rate of USD/NIS 3.766 (the rate at the time of approval).The total investment framework provided by the Authority amounts to approximately USD 120.74 million (NIS 454.74 million).

(7) The Authority pools resources from the participating government entities – The Committee for Budget and Planning, The Ministry of Innovation, Science and Technology, and the Innovation Authority – and transfers the annual participation payment to the EU. The total participation payment in 2024 was NIS 1,552 million – approximately EUR 388 million.

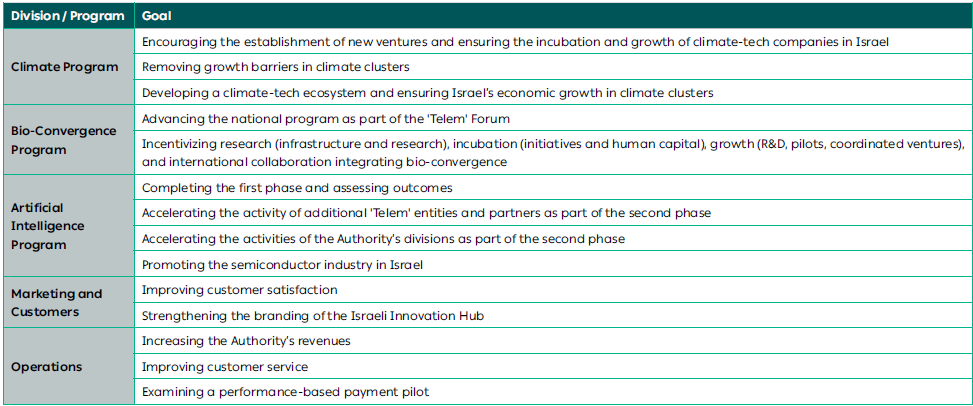

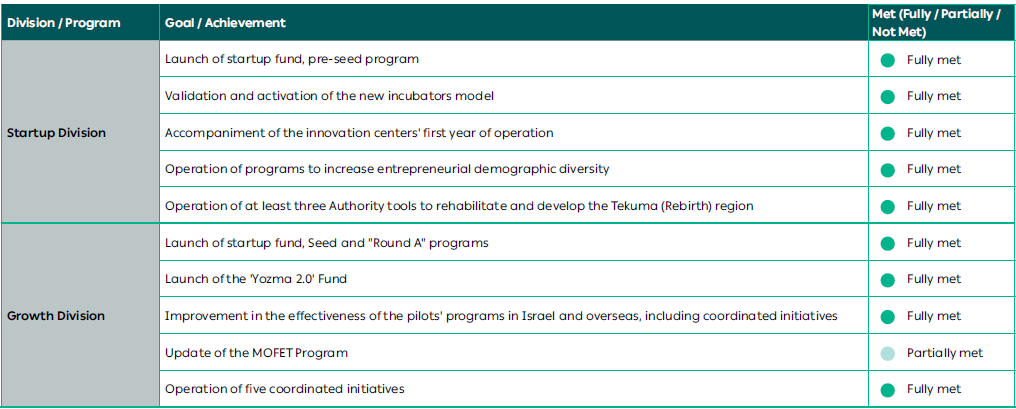

Appendix 4: Work Plans in 2024

Appendix 5: Work Plans in 2025