Innovation Authority Funding Policy for Early-Stage Startups

The Startup Fund: Addressing Market Failures of Early-Stage Startups

During 2024, the Israel Innovation Authority launched the ‘Startup Fund’ as the main instrument for financing early-stage Israeli technology companies. The Startup Fund replaced the R&D Fund, which had operated for many decades, with the aim of providing a precise and optimal response to the needs of the evolving Israeli innovation ecosystem.

The Startup Fund is designed to support the launch and financing of venture capital investment for deep-tech companies at all stages of incubation, from ideation to growth, in synchronization with the private market. Within the framework of the fund, the Innovation Authority participates in investment rounds starting from idea validation, pre-seed, through the seed stage, and up to the ‘Series A’ funding round. The goal is to ensure funding that is appropriate to the company’s current stage of development, thereby enabling companies to reach the next funding milestone (as opposed to rounds that are too small and do not sufficiently advance the company).

To achieve this objective, the Startup Fund’s operating principles are based on

several key pillars:

First, similar to the Authority’s other activities, and in accordance with the provisions of the Innovation Law, the Startup Fund aims to “directly or indirectly promote technological innovation activity in Israeli industry” (Section 15b). Accordingly, the companies chosen by the Innovation Authority for Startup Fund funding are those at early stages of development in R&D-intensive fields, and which have deep and high-risk technologies with breakthrough innovation i.e., similar to the definition of deep-tech companies as presented in this document. At the same time, companies must also meet additional criteria relating to their business characteristics and potential for success while relating, among other things, to the quality and experience of the team, marketing and business aspects, and the company’s potential impact on the national economy.

Second, in order to ensure the quality of companies, reduce private investors’ risk, encourage implementation of investments, guarantee that public funding generates economic value, and to align with the company’s organic growth process, the Innovation Authority’s investments via the Startup Fund are provided as part of the company’s fundraising round, with a requirement for matching – i.e., private market investment alongside state funding.

Third, as part of the Startup Fund’s creation, an examination was made of the market failures that characterize the financing of early-stage startups, where the risk to private investors is particularly high. T

The fund’s activity was therefore focused on high-tech sectors in which public intervention is needed most. To this end, the various sectors were ranked according to their availability of private capital, taking into account the number of companies and specialized investors, and the total sum of private capital invested in the sector, with an emphasis on private investors who had made a significant number of investments in that sector. The underlying rationale was that sectors with more widespread private market activity and more specialized investors with relevant depth and understanding operating in them are characterized by lower impact of government intervention, and less requirement for such intervention. Details and rankings of the sectors according to capital availability appear below.

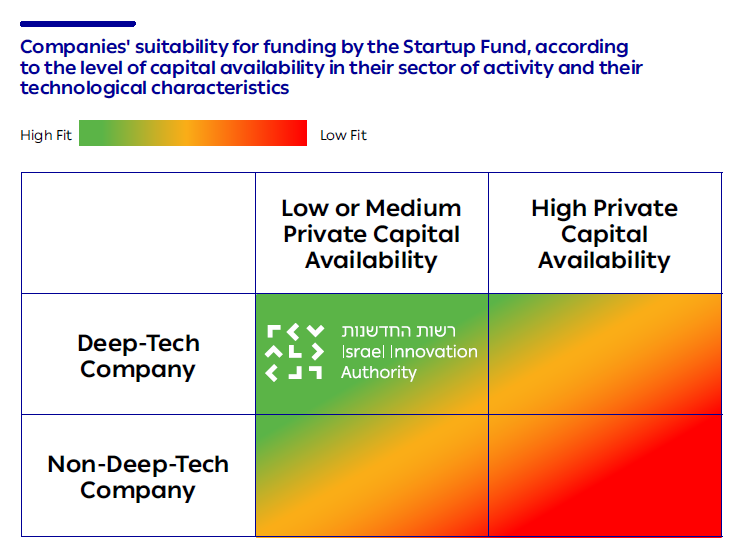

The following table describes the extent to which an Israeli technology

company is suited for funding by the Startup Fund, based on its technological

characteristics and the level of capital availability in its sector.

It should be emphasized that the capital availability ranking is not used as an automatic criterion for approving or rejecting companies. All companies submitting a request to the Startup Fund are fully and identically scrutinized. The ranking serves as an indication for the Innovation Authority’s Investment Committee with regard to ensuring the efficiency and quality of the Authority’s investment allocation, and is considered alongside the other parameters presented above. Moreover, the ranking is naturally expected to vary periodically according to changes in private capital availability in the various sectors of the Israeli high-tech industry.

In practice, of the total funding distributed by the Startup Fund, 90% was allocated to companies operating in sectors with low or medium capital availability rankings i.e., companies active in fields where raising private capital is significantly more difficult. Among the prominent sectors with low or medium capital availability are medical devices, semiconductors, and energy.

In contrast, in sectors with high capital availability rankings, such as cyber, fintech, and organizational software – where the capital markets are relatively well-developed – fewer companies receive Innovation Authority funding. Sectors with high capital availability comprise 10% of the total funding provided by the Startup Fund.

It is important to note that the Startup Fund is currently the only Innovation Authority program with a policy that integrates private sector investment and entrepreneurial activity in the relevant company’s sector into its decision-making process. This approach may, in the future, be integrated into additional Authority instruments that provide direct funding to companies (as opposed to activities intended to address other types of market failures, such as the development of R&D infrastructure).

Israeli High-Tech Sectors Ranked by Capital Availability

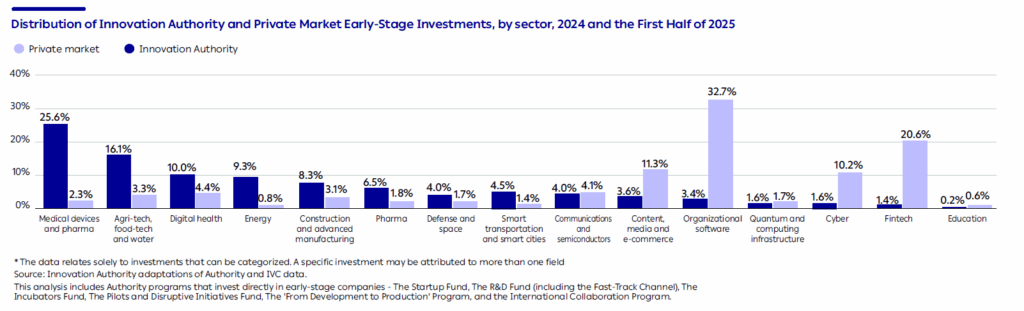

Innovation Authority Investments Are Concentrated in Fields With Less Private Investment

The Innovation Authority’s investments in Israeli technology companies focus on deep-tech companies and sectors typified by the probability of a financing market failure. A detailed explanation of this investment policy appears in Part B of this report.

The main sectors in which the Innovation Authority invests are medical devices and pharma, which together comprised about one third of all Innovation Authority investments in 2024. For comparison, these sectors represented only about 4% of all private market investments in early stages (up to and including Series A funding) during the same period.

Other key sectors for Authority investment include foodtech, agri-tech, water, and energy. Approximately 23% of Authority investments were directed to these sectors, compared to 4% of private market early-stage investments.

In contrast, the cyber and organizational software sectors – which attracted about 53% of all private market early-stage investments – received only 5% of the Innovation Authority’s investments.