2025 Overview:

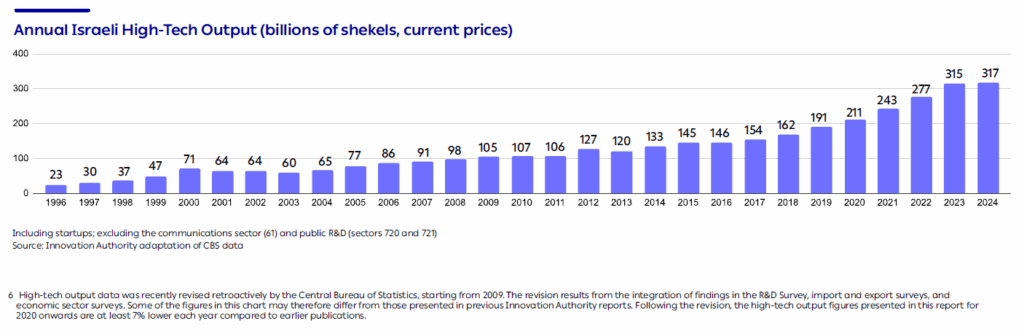

Stagnation in High-Tech Output Growth

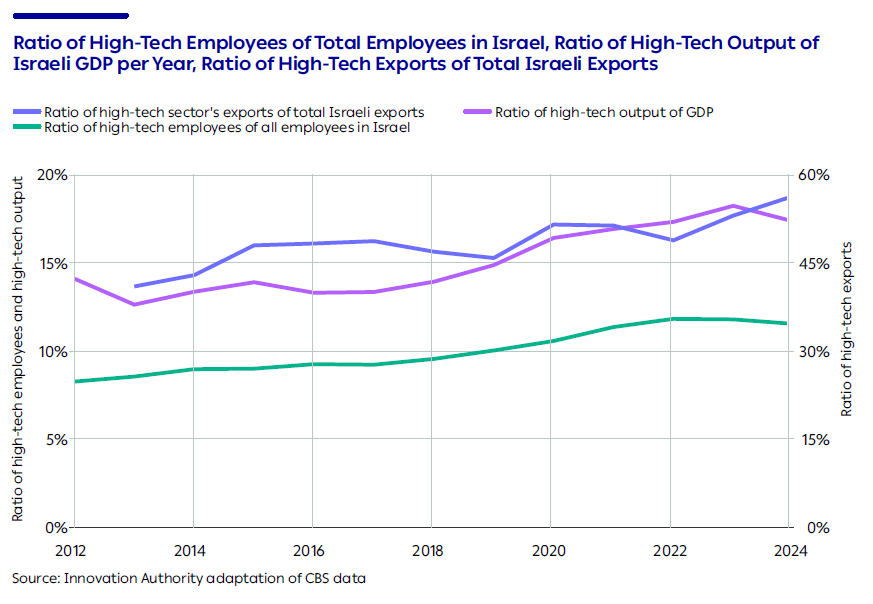

Recent years have been characterized by stagnation in high-tech output growth, similar to that observed in high-tech employment. In 2024, high-tech output totaled NIS 317 billion, constituting about 17.3% of Israel’s GDP.1High-tech output data was recently revised retroactively by the Central Bureau of Statistics, starting from 2009. The revision results from the integration of findings in the R&D Survey, import and export surveys, and economic sector surveys. Some of the figures in this chart may therefore differ from those presented in previous Innovation Authority reports. Following the revision, the high-tech output figures presented in this report for 2020 onwards are at least 7% lower each year compared to earlier publications. This means that high-tech output remained almost unchanged compared to 2023 (approximately NIS 315 billion), with high-tech output growth coming to a virtual halt at a rate lower than that of overall GDP growth.

How is the introduction of AI impacting high-tech output?

The data available at this stage reveals no measurable impact from the adoption of AI technology on changes in the sector’s labor productivity. Furthermore, the current period is characterized by other local and global events of macro-economic importance that may influence output, including the high level of interest rates, global geopolitical conflicts, the ongoing war in which Israel is engaged and the lengthy reserve duty of employees in the sector.

High-Tech’s Share in Israeli Exports Continues to Grow

High-tech exports from Israel continue to grow, particularly in the software sector. In 2024, high-tech exports totaled USD 78 billion, reflecting an average annual increase of 5.6%. Approximately 72% of high-tech exports stemmed from high-tech services exports (i.e., software companies), compared to less than 28% from high-tech industry exports – a sub-sector that has suffered ongoing stagnation (despite the seemingly increased demand for defense industry products).

In the first four months of 2025, the share of high-tech exports out of total Israeli exports continued to grow, reaching 57.2% of all Israeli exports – the highest rate recorded after the figure of 56.4% for the whole of 2024.

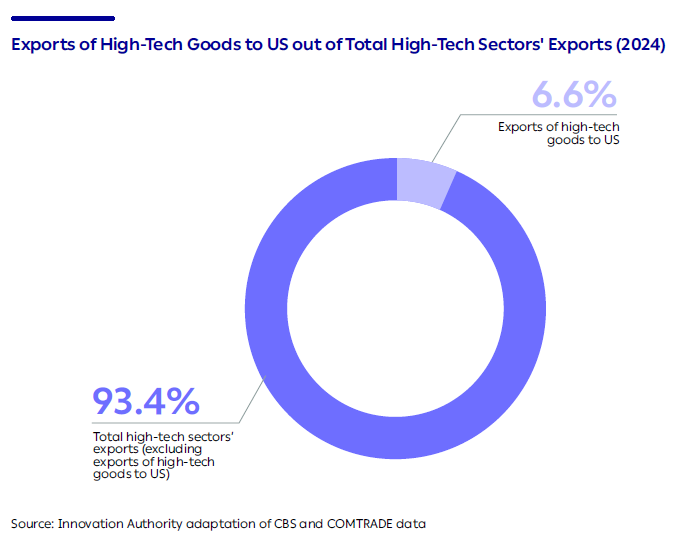

Less Than 7% of Israel’s High-Tech Exports are at Risk From Trump’s Tariffs

To assess the potential impact of tariffs on exports from Israel to the United States, this report presents an analysis of the possible exposure.2Trump’s tariffs, imposed under the “America First” policy, were intended to create a competitive advantage for American industry in global markets. The tariff rate imposed on exports from Israel to the US on most products under this policy is 15%.

In general, the shift of Israeli high-tech toward a service-oriented (i.e., software) industry, has led to a decline in the share of exports of goods (tangible products). As of 2024, the total high-tech goods (industry) exports from Israel comprises about 28% of all high-tech exports – a decline of approximately 60% compared to 2013.

Analysis indicates that the total high-tech goods exports to the United States stood at around USD 5 billion in 2024 – about one quarter of Israel’s total high-tech goods exports

In summary, high-tech goods exports to the United States comprised about 6.6% of Israel’s total high-tech exports in 2024. This ratio has been on a downward trend since 2016, when it stood at 10.4%.3In absolute terms, the total exports of Israeli high-tech goods to the US stood at around USD 4.3 billion in 2016 in current price terms. In other words, the decline in the share of Israel’s high-tech goods exports to the United States began even before the announcement of Trump’s tariff program. This trend mainly stems from the sharp increase in high-tech services exports during this period.

Israel is a Global Leader in R&D Expenditure as a Ratio of GDP

Israel continues to lead globally in state expenditure on research and development. In 2023 – the most recent year for which global comparison data is available – the ratio of national expenditure on civilian R&D as a percentage of GDP was 6.35%.4This figure includes private investment in startups. This marks an increase from 4.2% in 2014. Over this period, this figure increased gradually.

Second to Israel in expenditure on civilian R&D is South Korea, which approached 5% of GDP in 2023. In the United States – a large and diversified economy – national expenditure on civilian R&D stood at 3.45% – lower than the figures in Israel and South Korea, but higher than the OECD average of 2.7%.

Throughout the past decade, Israel has consistently led the world in expenditure on civilian R&D and even widened the gap compared to other leading countries. This reflects the central role of high-tech in Israel’s economy, although comparatively, state expenditure on R&D in Israel remains low in international terms.

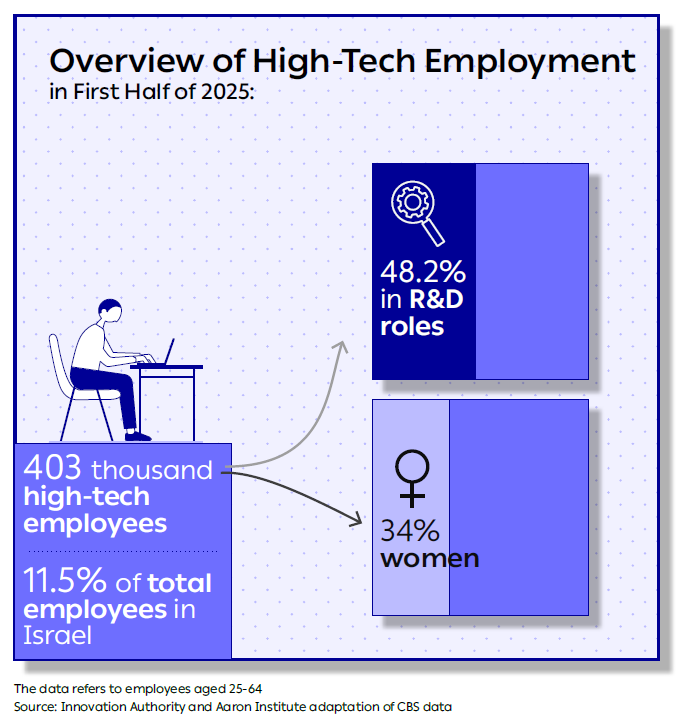

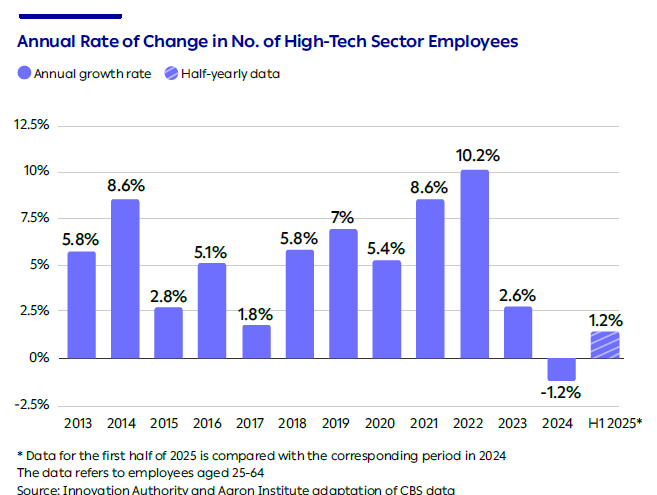

Continued Stagnation in the Ratio of High-Tech Employment

The stagnation in the ratio of high-tech employment has continued for the third consecutive year into 2025. As of the first half of the year, the ratio of high-tech employment out of all employees in the Israeli economy stands at 11.5%, compared to 11.3% in 2024 and 11.6% in 2023.

The total number of employees in the high-tech sector in the first half of 2025 stands at 403,000 – an increase of 1.2% compared to the same period last year. This is a lower growth rate than that which characterized Israeli high-tech until October 7, 2023 when the average stood at more than 6% in the first half of each year.

Of all high-tech employees in the first half of 2025, women accounted for 34%, and employees in R&D roles accounted for 48.2%.

During this period, a decline was recorded for the first time in the number of employees in R&D positions in the high-tech sector. Their number dropped by 14,000 compared to the first half of last year, a decline of 6.5%.10

High-tech employment trends were analyzed in detail in the High-Tech Employment Report 2025, which can be consulted for further insights.

During this period, a decline was recorded for the first time in the number of employees in R&D positions in the high-tech sector. Their number dropped by 14,000 compared to the first half of last year, a decline of 6.5%.5The sector’s employment figures are characteristically seasonal and may therefore change when examined annually.

An analysis of the annual growth rate in high-tech employment shows that since 2023 there has been a significant slowdown – averaging less than 2% per year. This follows a decade in which, in 8 out of 10 years, the annual growth rate of high-tech employment was 5% or higher – a figure that further highlights the current concerning state of hightech employment.

Another indication of the slowdown in employment growth is the stagnation in the ratio of high-tech employees out of the total number of employees in the Israeli economy. The stability of the high-tech employment ratio indicates that in recent years the sector has been growing at a pace similar to that of the overall economy, after several years in which it led employment growth.

High-Tech Employment is the Driving Force Behind the Sector’s Output and Exports

An analysis of macro-economic data reveals a strong correlation between high-tech employment, the sector’s output, and its attributed exports. Since 2012, a correlation of 0.95 has existed between the share of high-tech output in national GDP and the ratio of high-tech employees out of all employees in Israel. In other words, the two are almost fully correlated.6Correlation is a metric of the extent to which two variables move together. Correlation values range between 1 (variables that always move in the same direction) and -1 (variables that always move in opposite directions). Correlation does not necessarily indicate causality. Although it is impossible to infer causality from this finding, it does indicate the importance of high-tech employment for the Israeli economy as a whole.

Furthermore, there is a high correlation of 0.79 between the share of high-tech exports out of total exports and the ratio of high-tech output of GDP,7Although this correlation is indeed high, it is not perfect. For example, in 2024 an opposite trend was observed between the metrics, as the share of high-tech output out of total GDP declined while the share of high-tech exports out of total exports increased and of 0.78 between the share of high-tech exports and the ratio of high-tech employees out of all employees in Israel. In other words, the sector’s exports are also correlated with high-tech employment.

This finding is consistent with previous data published by the Innovation Authority, which illustrated the centrality of high-tech employment in the Israeli economy. Among other things, the data revealed that 85% of state revenues stemming from the high-tech sector are linked to employment in the sector (income tax, social security, etc.).

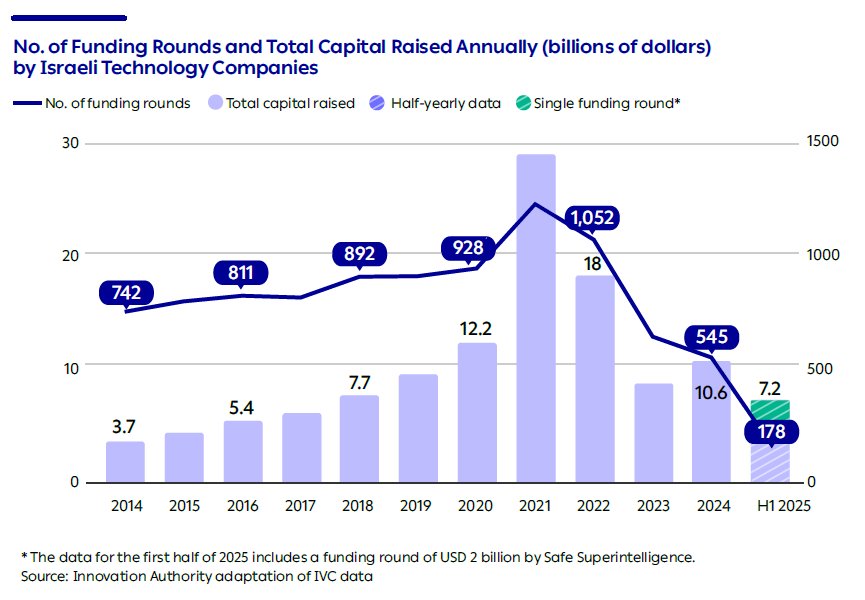

Investments in Israeli Startups Continue to Recover

In 2024 and the first half of 2025, investments in Israeli startups continued to recover, despite the war. The total capital raised by Israeli technology companies in 2024 amounted to USD 10.6 billion – similar to investment levels in 2019–2020.

As of the first half of 2025, Israeli high-tech companies had raised USD 7.2 billion. In other words, in just half a year they raised nearly 70% of the total capital raised in the entire previous year. It must be noted however, that these figures include a mega-round conducted by Safe Superintelligence, founded in part by Israeli entrepreneurs and operating an R&D center in Israel, which raised USD 2 billion in April 2025. Disregarding this megaround, the level of fundraising in the first half of 2025 is similar to that of 2024.

In addition, since 2021 there has been a steady decline in the number of startups’ fundraising rounds. This trend stems, in part, from delayed reporting of funding rounds, and while these figures are expected to be updated upward, the negative trend is expected to continue. This trend aligns with the decline in the number of startups founded over the past decade.

Quarterly data on high-tech companies’ fundraising shows that investments in Israeli startups increased in the second quarter of 2025, totaling nearly USD 5 billion.8It is important to note that the published data only includes the known transactions as of July 2025, leading to differences between the figures presented in this report and those published by the IVC and SNC databases, which monitor investment activity in Israeli startups. These databases use past data to provide estimates regarding the volume of transactions carried out during the first half of 2025 that have not yet been reported, and include them in their periodic publications.

As noted, about 40% of this sum was raised in a single USD 2 billion round by Safe Superintelligence. Nevertheless, even excluding this investment, this was one of the strongest quarters for Israeli startups’ fundraising since 2022.

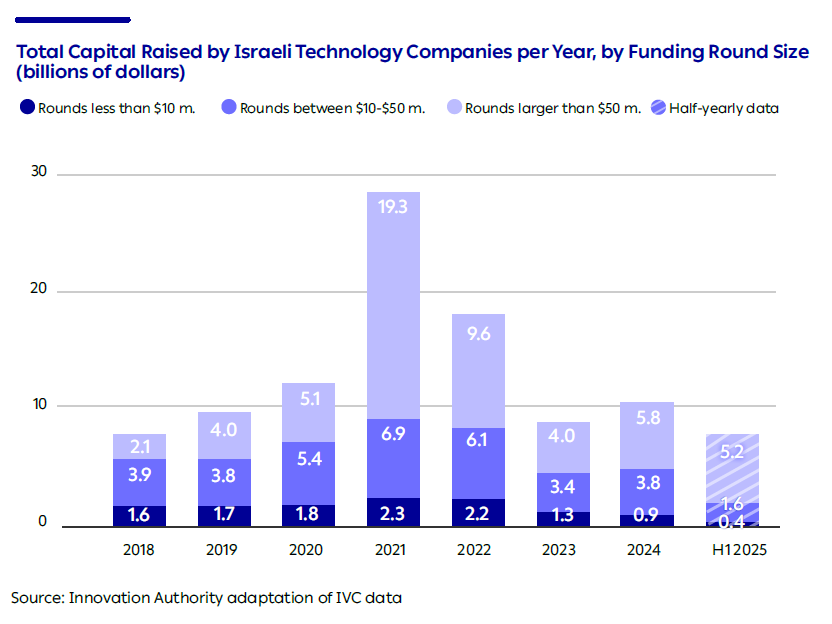

The Main Increase in Investments Was in Large Funding Rounds

In a trend similar to that of previous years, the majority of capital raised by Israeli startups in 2024 was via large funding rounds exceeding USD 50 million. Of the total capital raised in 2024, about 55% (USD 5.8 billion) came from rounds larger than USD 50 million.

This trend appears to be continuing in the first half of 2025, with more than USD 5 billion raised in large rounds (nearly half of which was, as noted above, in a single fundraising round).

An examination of the average round size across three funding size categories reveals no significant change in recent years (except in large rounds where variance is greater, since a few individual rounds can heavily influence the average).

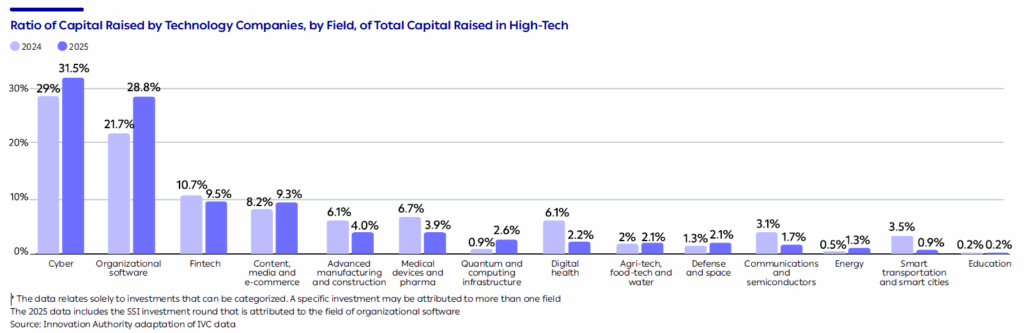

60% of Capital Invested in Israeli Startups in 2025: In Cyber and Organizational Software Companies

The cyber sector accounted for about 30% of investments in Israeli high-tech companies in 2024, and in the first half of 2025, this ratio rose to nearly one third of total investments. Excluding SSI’s mega-round, the cyber sector’s share of total investments in startups during the first half of 2025 rises to about 38%, compared to just 19% in 2023. In other words, cyber is attracting an increasingly significant share of startup investments in Israel.

Another key sector was organizational software, which attracted about 22% of investments in 2024 and around 29% in the first half of 2025. In total, approximately 60% of all capital invested in Israeli high-tech in 2025 was directed to cyber and organizational software companies. Other sectors account for a considerably smaller share of investments.

Relatively significant growth was also recorded in fundraising by companies in the quantum field. Since the beginning of 2024, quantum and computing infrastructure companies have raised approximately USD 400 million.

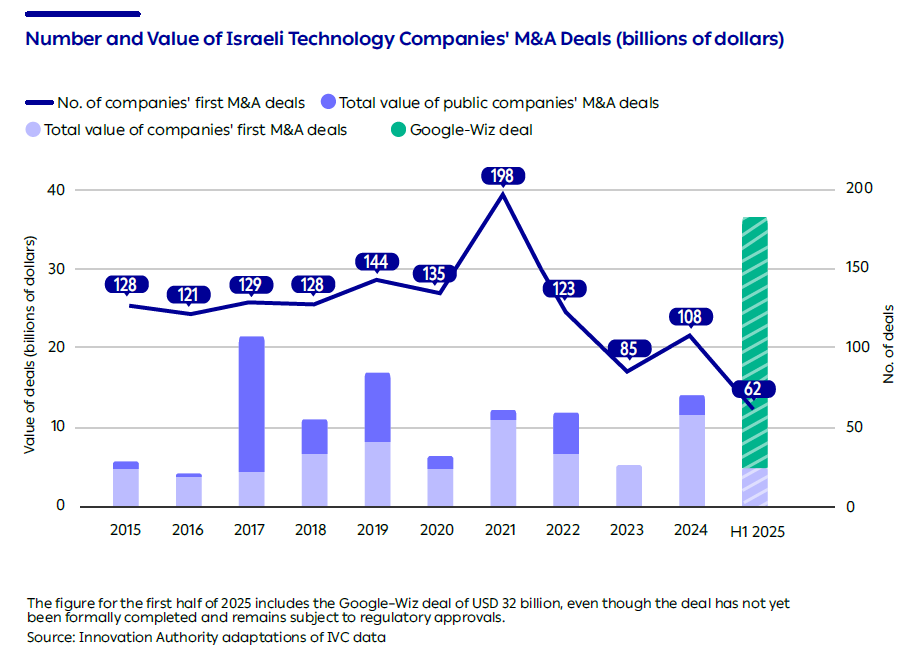

A Record Year of Growth in M&A Deal Value in Israeli High-Tech

The first half of 2025 witnessed the largest acquisition in the history of Israeli high-tech when Google acquired the Israeli company ‘Wiz’ for approximately USD 32 billion. As a result, 2025 is expected to be a record year for Israeli high-tech in terms of M&A deal value.

In 2024, more than 100 mergers and acquisitions (exits) of private Israeli high-tech companies were completed, totaling about USD 12 billion. These figures represent an increase in the number and value of deals compared to 2023, when 85 deals totaling USD 5.6 billion were recorded.

The value of acquisitions of Israeli technology companies in 2024 was the highest recorded in the decade until then – similar to the level recorded in 2021. However, the number of deals in recent years, since 2023, has been lower than the multi-year average of about 140 deals per year between 2015 and 2022.

Israeli Venture Capital Funds’ Fundraising Has Declined In the Past Two Years

22 Israeli venture capital funds raised USD 1.3 billion in 2024 – a decrease of about USD 1 billion compared to the amount raised by 34 Israeli venture capital funds in 2023.

During the peak years of high-tech in 2021–2022, around 60 Israeli venture capital funds raised USD 6 billion each year.

The data highlights two main phenomena: first, a decline in the average size of VC funds established in Israel in 2023–2024 to a level of USD 60–65 million, compared to an average fund size of at least USD 90 million in most years between 2017-2022. Second, it is evident that periods of global or local financial crises (after 2008 and in the last two years) have a significant impact on fundraising by Israeli venture capital funds.

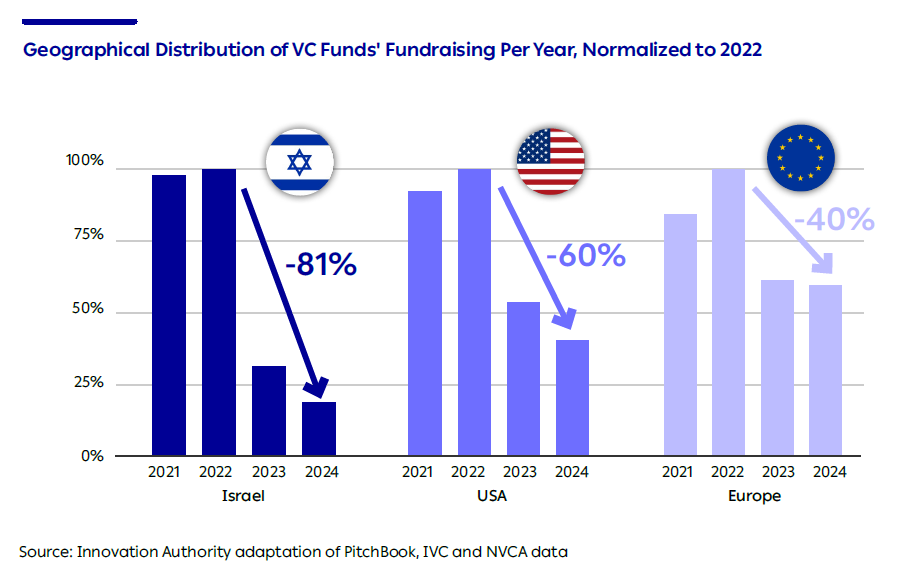

The Decline in Fundraising by Israeli Venture Capital Funds Is Sharper than in the US and Europe

The decline in fundraising by Israeli venture capital funds is not unique, and a similar trend has been observed since 2022 among funds in the United States and Europe. The decline in Israel, however, has been sharper than global trends: venture capital funds in the US raised USD 189 billion in 2022 and USD 77 billion in 2024 – a decline of about 60%. In Europe, the decline during this period was more moderate, at about 40%. In Israel, by contrast, the decline in total capital raised was significantly sharper and stood at 81% from 2022 to 2024.

It is important to note that in terms of the number of funds that raised capital during this period, all three regions saw a similar decline of around 65%. In the United States, the number of funds that raised capital fell from 1,650 in 2022 to 538 in 2024; in Europe, from 556 to 203 funds; and in Israel, from 64 funds in 2022 to 21 funds in 2024. In other words, the sharper decline in VC fundraising in Israel stems from a greater decrease in the average size of the funds raising capital.

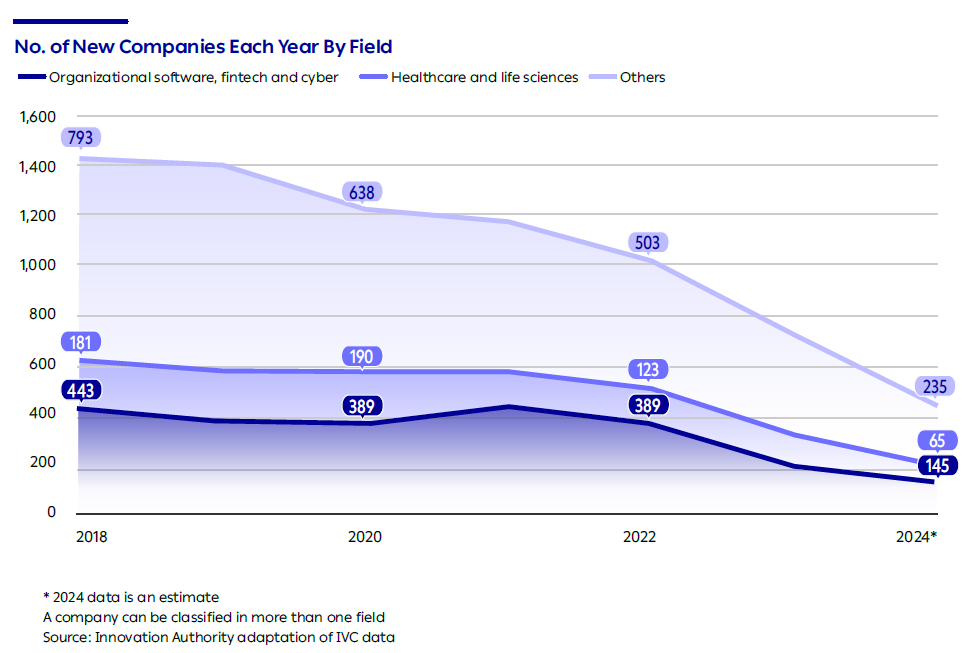

New Startup Formations Continue to Decline

The multi-year negative trend of new technology company formation in Israel, which began in 2014, continued in 2024. According to available data, around 500 new startups were established in 2024, compared to 622 in 2023. These numbers are expected to be updated upward as additional startups established in those years are identified. Nevertheless, since 2020, it appears that less than 1,000 new technology companies have been established annually. Previous publications by the Innovation Authority indicate that this is a global trend and not one unique to Israel.9See publication on the establishment of new startups

At the same time, in 2024 there was an increase of over 50% in the number of applications to the Innovation Authority’s Tnufa Program which supports startups at the ideation stage (from 340 applications in 2023 to more than 500 in 2024). This increase may be an early indication of a rise in the establishment of new Israeli technology companies.

Questions remain as to how this trend will evolve in the future: will the decline in new technology company formation continue? Will the annual number of new companies stabilize around a similar level, or will the trend be reversed as the result of new initiatives based on Artificial Intelligence or increased entrepreneurship in high-demand fields such as security?

Most New Companies: In the Fields of Organizational Software, Fintech, E-Commerce, and Cyber

Within the overall decline in entrepreneurial activity, reflected in the downturn in new company formation, several changes can be identified in the composition of the new companies. These changes are expected to impact the face of Israeli high-tech in the coming years as young companies mature and grow.10The data may be updated in the future due to methodological challenges related to late detection

In the organizational software sector – the largest field in which new companies are established – there has been a decline in the number of new companies. For example, in 2018, about 240 new companies were established in this field, compared to around 130 in 2023. A further decline was registered in 2024 (although the number is expected to increase as data is updated).

An analysis of companies by sector shows an increase in recent years (2018-2024) in the relative share of new companies established in cyber, medical devices, and energy (out of companies whose field of activity is currently known). By contrast, in the content and media sector there has been a decline in the relative share of new companies.

Looking at the next generation of Israeli startups, more than half of the high-tech companies established in Israel over the past three years (2022–2024) operate in one of the following four sectors: organizational software (22.2% of new companies), fintech and e-commerce (about 10% each), and cyber (9.6%). In other words, Israeli high-tech appears to remain focused on the sectors that have been at the forefront in recent years.

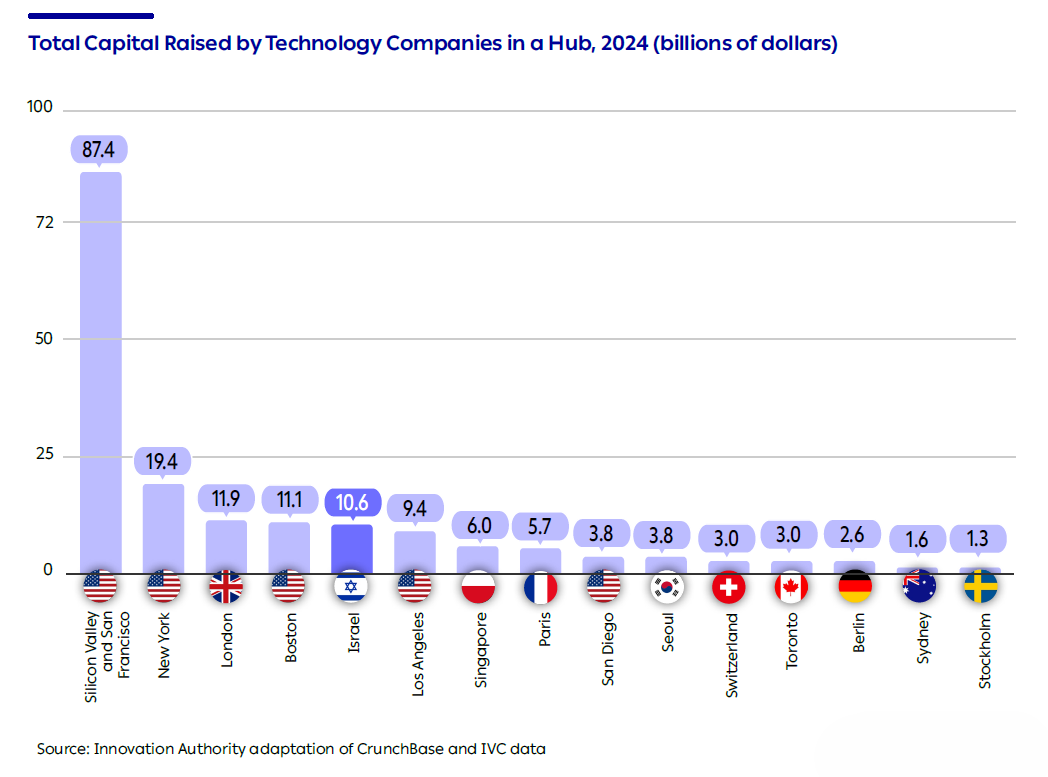

Israel is the Fifth Largest Global Startup Fundraising Hub; London Continues to Grow

In 2024, Israel was the fifth-largest hub in the world in terms of capital raised – with total fundraising of USD 10.6 billion, similar to its global position in 2023.

Silicon Valley continues to serve as the global magnet for venture capital investments, with close to USD 90 billion invested in 2024. Companies operating in this region attracted 4.5 times more investment than companies in New York, the world’s second-largest hub.

Investments in Israel increased by about 22% in 2024 compared to the previous year – slightly higher than London (18%) and slightly lower than New York (28%). Here too, Silicon Valley showed the fastest growth rate, with an increase of about 60% in investments in 2024 compared to 2023.

It is noteworthy that London’s growth continues, with the city ranked as the world’s third-largest fundraising hub in 2024. Until 2021, total startup fundraising in London was lower than in Israel and Boston, but has shown accelerated growth in recent years.

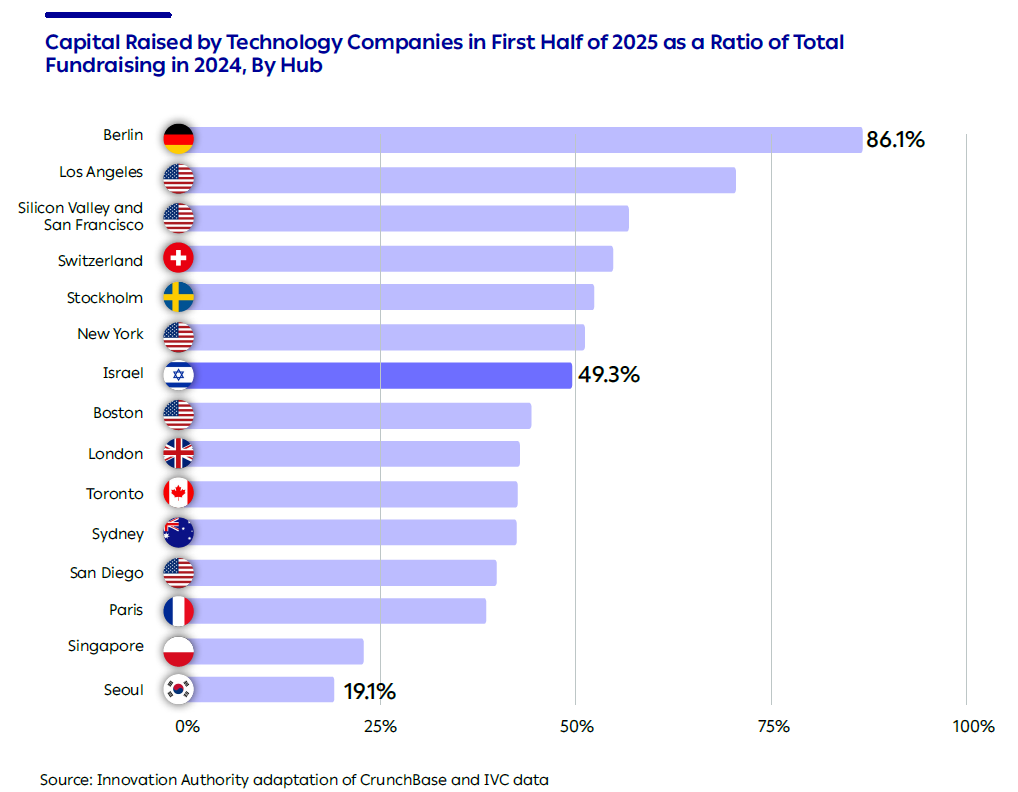

The pace of startups’ fundraising in major global technology entrepreneurship hubs remained similar in the first half of 2025 to the level recorded in 2024.

In most of the key hubs examined, technology companies raised 42%–57% of the total annual capital raised in 2024 during the first half of the year.11Silicon Valley and San Francisco figures do not include OpenAI’s USD 40 billion fundraising, and Israel’s figures do not include Safe Superintelligence’s USD 2 billion fundraising. When these rounds are included in the calculation, the fundraising pace in the first half of 2025 reaches 102% in San Francisco and Silicon Valley, and close to 70% in Israel. In Israel, half (49.3%) of the total capital raised in 2024 was raised in the first half of 2025. In other words, in most hubs the fundraising pace is similar to that of 2024, and if continued at this rate, the total for 2025 will be similar to the sum raised in the previous year.12In recent years, the multitude of macro-economic events and significant fluctuations in investor preferences and capital flows have made it difficult to assess seasonal effects. It is not therefore possible to determine whether total fundraising in the second half of the year will be higher or lower than that observed in the first half.